As you know, putting money in your retirement account is the ultimate action step Kid$Vest recommends to kids from age 10-20. All you need to start a Roth IRA is to work part or full-time and have taxable compensation. Also, if you are under age 18, a parent must be the account custodian. Neither of these requirements are a big deal!

Why should you start your Roth IRA as soon as possible?

First, each dollar you earn up to $5,500 per year can be put into your Roth IRA by you, or your parents/grandparents. This means you can get help saving for retirement. Lucky kids sometimes get matching funds from parents/grandparents for work performed.

Second, before age 20, you likely have no or low expenses—for cars, phone, cable, or school. Many times, parents shelter you from expenses like healthcare or clothes. And at this income level, your taxes will be miniscule. Obviously, you won’t want to put your entire earnings into your Roth IRA because you will need money for expenses, savings, and fun.

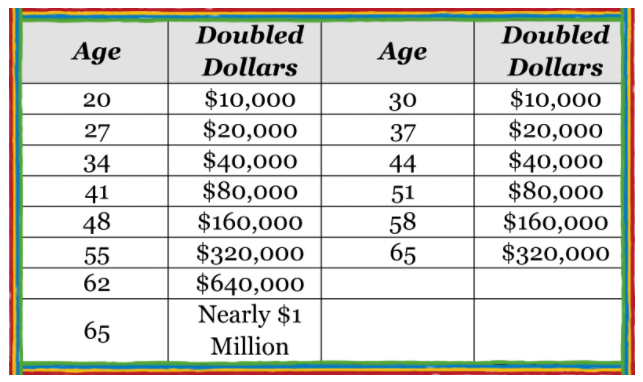

Third, compound interest is the “miracle” that allows money saved in your teens to double one or two times more than if you wait until you are age 25-30. For example, assuming a 10% interest rate, it will take approximately 7.2 years for your money to double. If you have $10,000 saved by age 20, you will have nearly $1,000,000 saved by age 65, even if you add no additional dollars to your retirement portfolio. However, if you wait till age 30, your $10,000 initial investment will total approximately $320,000 by age 65. That additional 10 years of compounding cost you roughly $600,000. That’s a big deal! Look at the chart below.

Fourth, we know kids who put money away early in life typically develop sound financial habits and will likely save many more dollars in future IRAs or 401(k)s. This will guarantee their DreamLife comes true. This is what The Kid$Vest Project is all about.

Finally, the Roth IRA provides you with numerous opportunities to withdraw money, with and without penalties and taxes, before you reach 59 ½. But I “gotta” tell you, if you want to start building financial independence during your life and at retirement, we don’t want you to even entertain thoughts of reducing your funds when you are young.

So, take advantage of the financial knowledge Kid$Vest offers on this website and if you want, start your first Roth IRA by hitting this link. It will take you to the Kid$Club Membership page. There, you will read stories of other youth’s successes and be able to upload you own story. You will also be automatically signed up for our weekly blog information and can initiate your personal Roth IRA.

Kid$Vest wishes you the best of luck!